Understanding the Current Dynamics of the Dubai Real Estate Market

The Dubai real estate market has witnessed a recurrent query in the recent years; “What will happen, and is there a potential crash?” To respond to this question, it is necessary to explain the difference between the two terms which are often mixed up- “need” and “demand”, besides analyzing the demographic and economic factors that are currently impacting the market.

Defining Key Concepts: Need vs. Demand

Need: A need means an essential that is strictly necessary for life. In real estate, a “need” is the most common kind of reality people have- a house which they definitely will have regardless of any economic speculation or rental yield.

Demand: Demand consists of the basic necessity of living and having a place to stay plus the wishes to buy property for various reasons such as investment potential or simply following the market. While a “need” is an issue of necessity, “demand” can have influences from outside -such as policies that allow one to benefit from taxes, rates of mortgage being very attractive, the buzz of a particular neighborhood, the perception of long-term undervaluation’s yield. All these factors can contribute to “demand” or the choice of going for a property that can actually give you a mortgage or maybe set you up with a business in that place.

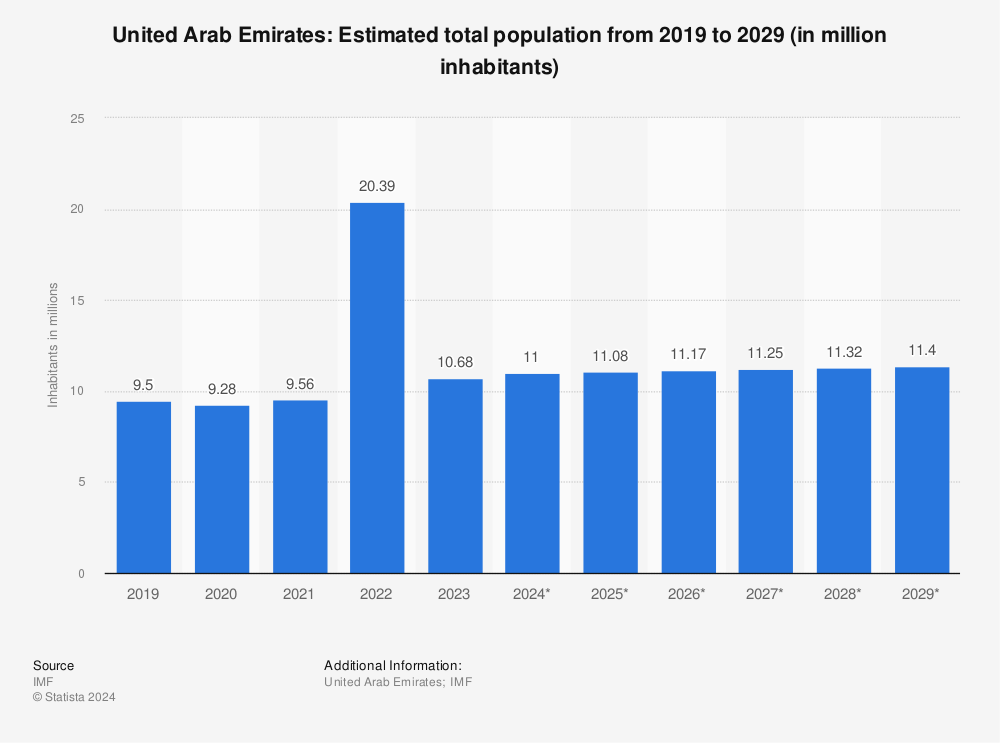

Population Growth and Its Impact on the MarketThe recent spell of urban migration in the UAE serves as a predictive tool to gauge the future of the real estate market in Dubai. As per the reports published by Statista and the government Maghreb, it is noted that there is a strong continual rise in the population in the United Arab Emirates, particularly the crash of the COVID-19 epidemic, which caused a full-on halt to migration earlier and then gradually, due to the long months of strict biclass and health measures people moved back to the territory.

Pre-Pandemic Levels: The population of the UAE was roughly estimated at around 9.5 million in the year 2019.

Pandemic and Post-Pandemic Spike: The prompt, adept, and well-organized actions that the government of the UAE took in controlling the COVID-19 crisis such as fast testing, quick coverage of vaccines, and all-encompassing aid programs turned the country into a preferred destination for expatriates who seek safety and stability of community and also business continuity. Adding to that, the globally introduced events like Dubai’s Expo 2020 and the worldwide political changes that took place mainly the Russia-Ukraine crisis helped increase the number of foreign residents and investors in the country.

The result was, by 2023 the inhabited community of the UAE was a little over 10.7 million according to Statista’s figures. The definitive forecast would be that the population could amount to beyond 11 million by 2025, as per many estimates, and would feature a modest yet continuous growth rate in the latter part of the decade.

Connecting Population Growth to Property DemandThe increase in the population is not just a figure; the housing market is directly affected by it. Think about this theoretical situation:

The increase in the population of the UAE in the 2020 to 2024 period was estimated at about 1.7 million people.

If we may assume that for every five newly arrived expatriates, one new household will participate, then that number would grow to around 340,000 additional housing units which will cater to the new comers.

Before that increase in influx, the annual absorption rate of the market-condition properties—the minimum number of properties needed to meet steady-state conditions—was maybe around 30,000-40,000 new units per year. For a period of three years, that would mean a little bit over 120,000 units.

The Sustained “Necessity”: A typical group of buyers and renters is empty from the list; nevertheless, they are predominantly a must-have group of people who are new arrivals and foreign residents moving to the UAE. Most of those people require a home that is why there is a constant basic demand.

Long-term Investors: A large part of real estate purchases may not have necessarily been the speculative types, but rather longer-term ones. They were well known with the choice of the Dubai emirate for their investment thereby leading to its stability, business-friendly policies, and world-class infrastructure. Such investors usually follow a more rational, strategic decision-making style instead of the frantic selling approach.

Gradual Supply Adjustments: While it may take a long time to make 500,000 new units available to the market, new projects are however coming up. This is likely to bring about a gradual change of the market in the next 5-6 years as families will become after the new normal during the pandemic, will take their revenge on the market for a bunch of items we have postponed so far. Through this integrated mid-term period, supplies will become programmed to track the market’s requirements by that point in time.

Price Growth Moderation: It is reasonable to assume that the cost of goods will neither plummet nor shoot through the roof. After the initial frenzy and erratic price changes, prices are likely to return to a more reasonable and stable level thus resulting in a slight market cool-off. Such a state of affairs would denote not just the real demand from end users but also careful, sustainable investment, in lieu of ephemeral speculative events.

Conclusion

The Dubai real estate market is currently navigating a complex interplay of needs and demand—factors driven both by population growth and changing investor sentiment. While the market has experienced intense competition and upward pressure due to a surge in new residents, the fundamentals remain strong. Ongoing infrastructure development, governmental support, and investor confidence make it unlikely that a sharp crash will occur in the near term.

Instead, over the next three to four years, the market is expected to transition into a more balanced phase, with price growth softening into moderate, sustainable increases. By approximately 2028–2029, as new projects reach completion and address both accumulated and ongoing demand, the Dubai property scene will likely settle into a healthier, more stable pattern—one driven by robust fundamentals rather than short-lived hype.

Join The Discussion