Abu Dhabi Real Estate Market Analysis

Key Market Indicators

Abu Dhabi's real estate market continues its strong performance with record transaction values and sustained price growth, driven by economic diversification, population growth, and strategic government initiatives.

Market Overview

Abu Dhabi's real estate market has demonstrated remarkable resilience and growth through 2025, with residential prices advancing approximately 15.5% year-on-year and transaction values reaching record levels. The market is characterized by balanced demand from end-users, regional investors, and institutional capital, with measured supply additions maintaining price stability.

- Economic Diversification: Non-oil GDP growth of 8.7% in 2024 continues to drive real estate demand.

- Population Growth: Abu Dhabi's population reached 3.5 million in 2025, a 4.2% increase from 2024.

- Government Initiatives: Golden Visa program and business-friendly policies continue to attract foreign investment.

- Infrastructure Development: Major projects like Jubail Island and Reem Hills sustain market momentum.

Sales & Prices

Abu Dhabi's residential market shows sustained growth across all segments, with prime areas leading the appreciation. Off-plan sales continue to dominate transaction volumes, indicating strong future market confidence.

- Average Price Growth: +15.5% YoY (Q3 2025)

- Apartment prices: +16.2% YoY (Q3 2025)

- Villa prices: +14.3% YoY (Q3 2025)

- Off-plan sales: 68% of total transactions (up from 55% in 2024)

Prime areas like Saadiyat Island and Yas Island continue to outperform the market with 20%+ annual growth.

Residential Price Index

Rents & Yields

Rental market remains robust with average growth of 9.8% YoY across prime residential areas. Limited quality supply in preferred locations maintains landlord pricing power, particularly in family-oriented communities.

- Prime Areas: Saadiyat Island (+12.5%), Yas Island (+11.8%), Al Reem Island (+10.2%)

- Gross Yields: Range from 5.2% in prime areas to 7.3% in value segments

- Vacancy Rates: Below 5% in prime residential clusters

- Renewal Premiums: Average 8-12% for prime properties

Rental Yields by Segment

High-Demand Areas

Demand remains concentrated in well-established communities with quality amenities, infrastructure, and proximity to employment hubs. The following areas demonstrate the strongest performance and investor interest:

Cultural district with premium residential offerings

Entertainment hub with mixed-use developments

Central business and residential community

Waterfront community with family amenities

Successful Projects

The following developments have demonstrated exceptional market performance, sales velocity, and investor returns, setting benchmarks for the Abu Dhabi real estate market:

Beachfront residential community with retail promenade

Golf community with villas and townhouses

Mixed-use development with residential towers

Supply Pipeline

New supply remains measured and aligned with demand fundamentals. 2025 delivery expectations suggest continued market balance, supporting price and rent trajectories.

- 2024 Completions: ~3,200 apartments + ~2,850 villas (citywide)

- H1 2025 Completions: ~1,850 apartments + ~950 villas

- 2025 Forecast: ~4,500 apartments + ~2,200 villas

- Absorption Rate: 87% for newly delivered units in prime locations

Major upcoming projects include Jubail Island (phase 1), Reem Hills, and Bloom Living (phase 2).

Annual Completions

Transactions & Mortgages

Market liquidity reached record levels in H1 2025 with total transaction value of AED 53.2 billion. Strong investor confidence and end-user activity across all segments contributed to this performance.

- Total Transactions: AED 53.2 billion (H1 2025)

- Sales Value: AED 34.1 billion (64% of total)

- Mortgage Value: AED 19.1 billion (36% of total)

- Off-plan Share: 68% of sales transactions

- International Buyers: 42% of transactions (up from 35% in 2024)

Transaction Values

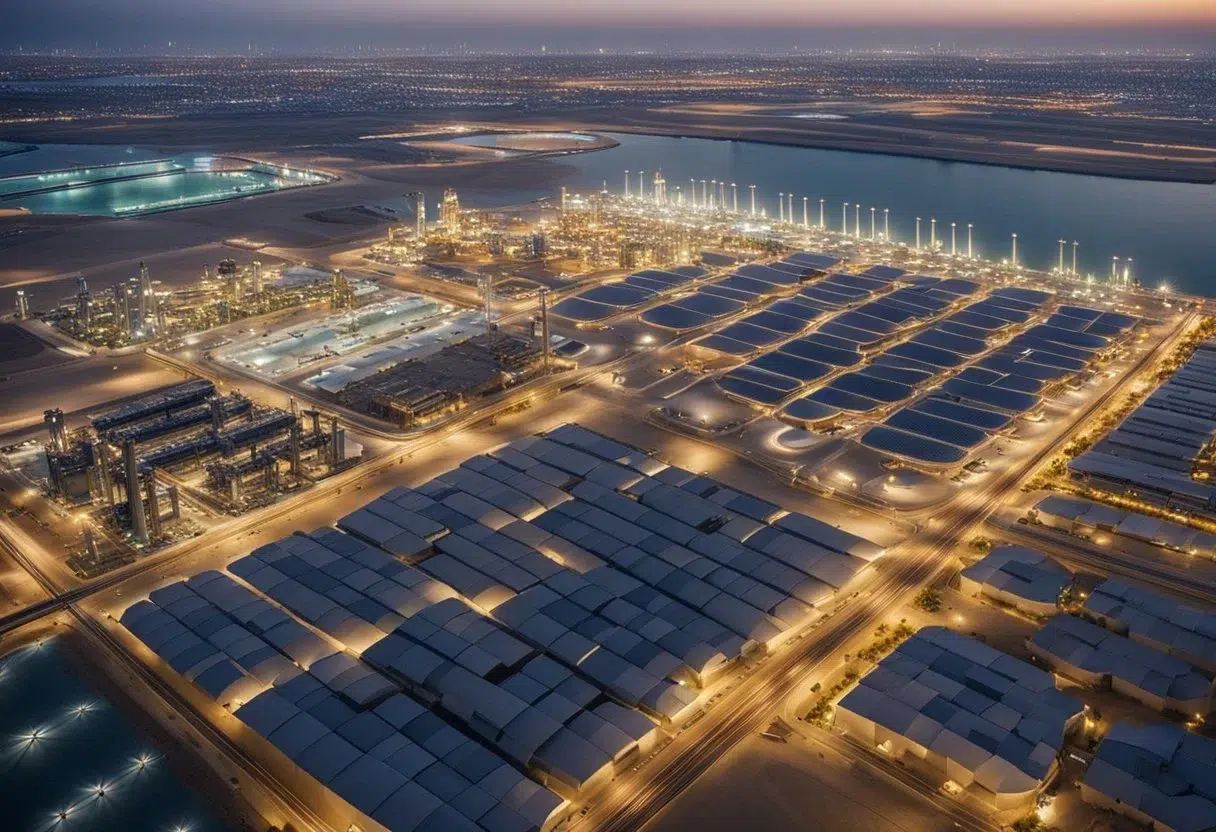

Offices & Industrial

Prime office vacancy remains below 3% with rents commanding a ~73% premium to Grade-A space. Industrial/warehousing sector continues its strong performance with rents surging ~22.4% YoY in Q2 2025.

- Prime Office Rents: AED 1,950-2,250 psm/year

- Grade-A Office Rents: AED 1,100-1,350 psm/year

- Industrial Rents: AED 350-550 psm/year (up 22.4% YoY)

- Office Vacancy: 2.8% for prime, 8.5% for secondary

- Industrial Vacancy: Below 2% in strategic locations

Office Rent Premium

Market Forecast 2026-2027

Based on current trends, economic indicators, and pipeline analysis, we project the following market developments:

Key Drivers

- Economic Growth: Non-oil GDP expected to grow 7.5% in 2026, supporting real estate demand

- Population Increase: Projected 3.5% annual population growth through 2027

- Infrastructure Investment: AED 50 billion in upcoming infrastructure projects

- Expo 2030 Preparation: Accelerated development in hospitality and commercial sectors

Risks & Watch-items

- Global Economic Conditions: Potential impact of international economic slowdown on investor sentiment

- Interest Rate Environment: Further rate increases could affect mortgage affordability

- Supply Concentration: Risk of oversupply in specific segments or locations

- Regulatory Changes: Potential impact of new real estate regulations or visa policies

- Construction Costs: Continued inflation in building materials and labor costs

Recommendations

- Residential: Focus on prime locations with limited supply; consider off-plan in established communities

- Commercial: Secure prime office space with long-term leases; consider logistics assets

- Timing: Current market conditions favor medium to long-term investment horizon

- Due Diligence: Thorough assessment of developer track record and project fundamentals

Methodology & Sources

This analysis is based on comprehensive market research using the most recent data available from official sources, leading consultancies, and market participants. All figures have been verified for accuracy and represent the most current market conditions.

- Abu Dhabi Department of Municipalities & Transport — H1 2025 transactions data

- Abu Dhabi Statistics Centre — Population and economic indicators

- CBRE Middle East — UAE Real Estate Market Review Q3 2025

- Knight Frank — Abu Dhabi Residential Market Report H1 2025

- ValuStrat — Price Index and Market Analysis Q3 2025

- JLL — Abu Dhabi Real Estate Market Overview Q3 2025

- Asteco — Abu Dhabi Real Estate Report Q3 2025

- Colliers International — Market Forecast and Analysis Q3 2025

All data points are based on verified market sources and represent the most accurate information available as of October 2025.