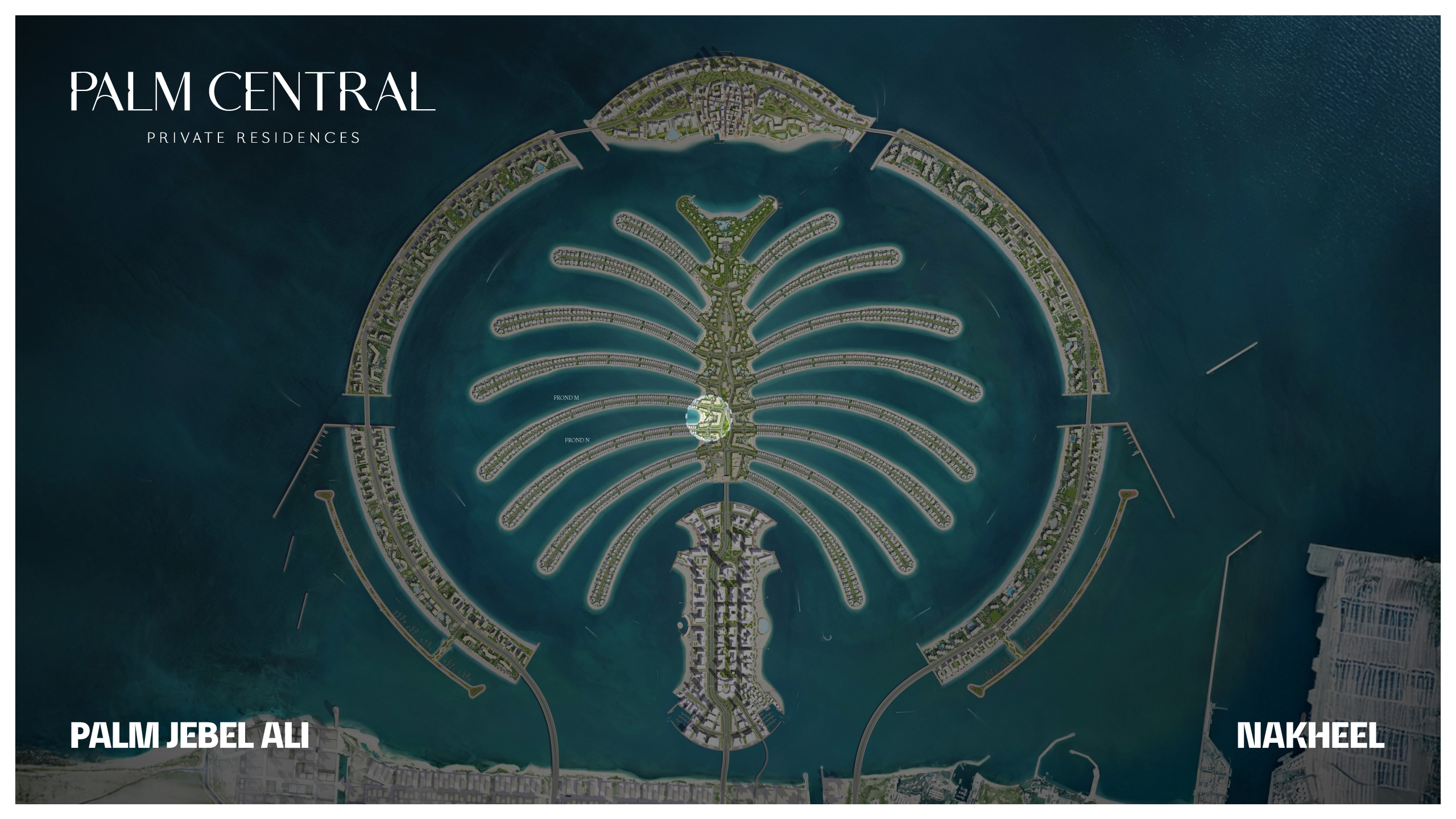

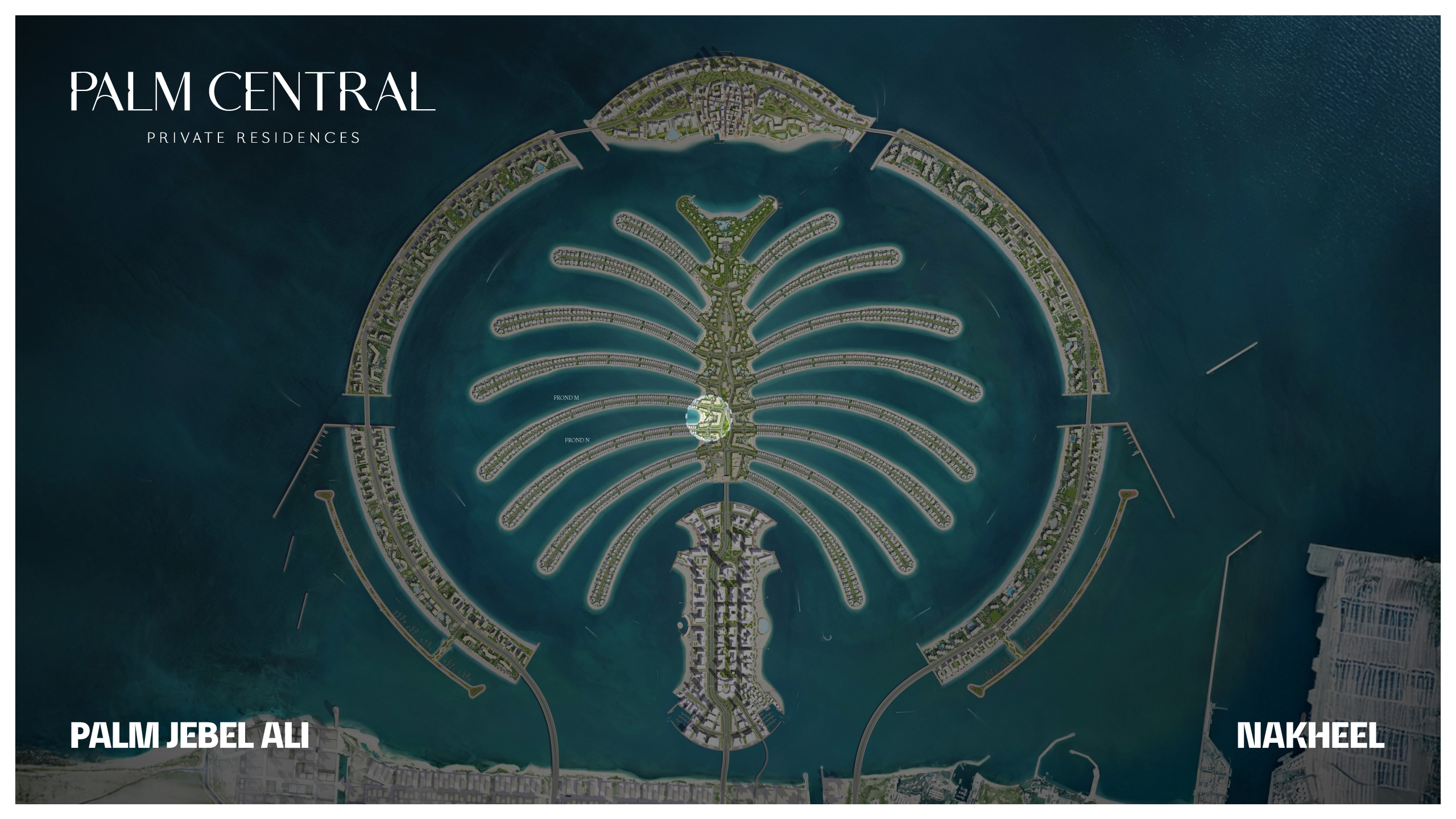

Palm Central at Palm Jebel Ali appears strategically undervalued vs ultra-luxury peers on Palm Jumeirah and Emaar Beachfront. Launch PSF around AED 3,200–3,401 sits 9–26% below Emaar Beachfront and 24–90% below new ultra-luxury towers on Palm Jumeirah, while offering direct waterfront, low-rise exclusivity, and deep amenities. As PJA infrastructure delivers, PSF convergence toward AED 5,000+ is expected.

Palm Central — Strategic Undervaluation Thesis

Benchmarking Palm Central at Palm Jebel Ali (PJA) against high-profile luxury peers shows a clear early-mover discount with significant upside as the island matures.

Snapshot & Masterplan Context

Low-rise ultra-luxury fabric on a future super-prime island; early phases benefit from developer price-stepping.

Detailed PSF Comparative Benchmark (Off-Plan)

| Project / Location | Property Segment | Estimated Off-Plan PSF (AED) | Δ vs Palm Central | Key Value Proposition |

|---|---|---|---|---|

| Palm Central, PJA | Ultra-Luxury Launch | AED 3,200 – 3,401 | — | New ultra-luxury waterfront mega-project on PJA spine |

| Como Residences, Palm Jumeirah | Ultra-Luxury Branded Tower | AED 5,173 – 6,500+ | ≈ 53% – 90% Higher | Established ultra-prime address; signature architecture |

| Passo by Beyond, Palm Jumeirah | Ultra-Luxury Tower | AED 4,233 – 5,682+ | ≈ 24% – 67% Higher | Prime location; exclusive designer offering |

| Emaar Beachfront (Avg Launch) | Prime Waterfront | AED 3,700 – 4,042 | ≈ 9% – 26% Higher | Ready-infrastructure, private beach access (smaller scale) |

| MJL (Jomana/Riwa) | Prime Luxury (Non-Waterfront) | AED 2,400 – 3,100 | ≈ 6% – 29% Lower | Community focus; Burj Al Arab views; integrated low-rise |

Undervaluation Thesis

PJA is a master plan in progress; Palm Jumeirah is a mature icon. Investors are effectively buying the future value of a larger, more modern Palm at today’s early-mover price. As infrastructure, marinas and resorts deliver, the PSF gap to ultra-luxury PJU (AED 5,000+) should narrow—potentially surpass in select segments.

Executive Summary

Palm Central is not “cheap” in absolute terms — yet it is strategically cheap against future status and ultra-luxury peers. The window captures both developer price-stepping and macro convergence as Palm Jebel Ali completes.