Prepared For: Institutional Investors & High-Net-Worth Individuals

Date: 25 June 2025

Report Version: 4.0

(Data verified by Dubai Land Department, Reidin Analytics, and Meraas disclosures)

I. Executive Summary

| Metric | Value | Source |

| Location | Nad Al Sheba 1, Dubai | Meraas Master Plan (2023) |

| Developer | Meraas Holding (A+ Rated) | Moody’s (2024 Report) |

| Total Phases | 7 | DLD Project Registration #NASG-11220 |

| Capital Appreciation | +142% (Phases 1-4) | Reidin Capital Gains Index (Q2 2025) |

| Competitive Advantage | Dubai’s only wellness-centric gated community | CBRE Community Benchmarking 2025 |

🔑 Key Insight: NASG is Dubai’s top wellness-driven community, delivering 140%+ returns in early phases. Meraas’ A+ rating ensures project reliability and premium valuation.

II. Financial Analysis by Phase

Verified Transaction Data (DLD & Property Monitor)

| Phase | Delivery | Launch Price (3BR Townhouse) | Current/Projected Price | ROI | Status |

| Phase 1 | Q2 2025 | AED 3.43M | AED 8.97M | 162% | 98% Sold |

| Phases 2-4 | Q1 2027 | ~AED 3.8M | AED 9.2M | 142% | 92% Sold |

| Phases 5-6 | Q3 2027 | AED 4.18M+ | >AED 9.5M | >100% | 85% Sold |

| Phase 7 | Aug 2028 | AED 4.43M (TH) | TH: >AED 12.5M (2030) | >180% | 76% Sold |

Key Notes:

- Highest ROI: Phases 1-3 townhouses (160%+ gains).

- Phase 7 Villas: Launch: AED 11M → Current Avg: AED 17.45M (59% gain).

💡 Highest ROI in Phases 1-3 townhouses (160%+). Phase 7 townhouses offer 180%+ upside by 2030 – avoid villas for short-term gains.*

III. Investment Catalysts

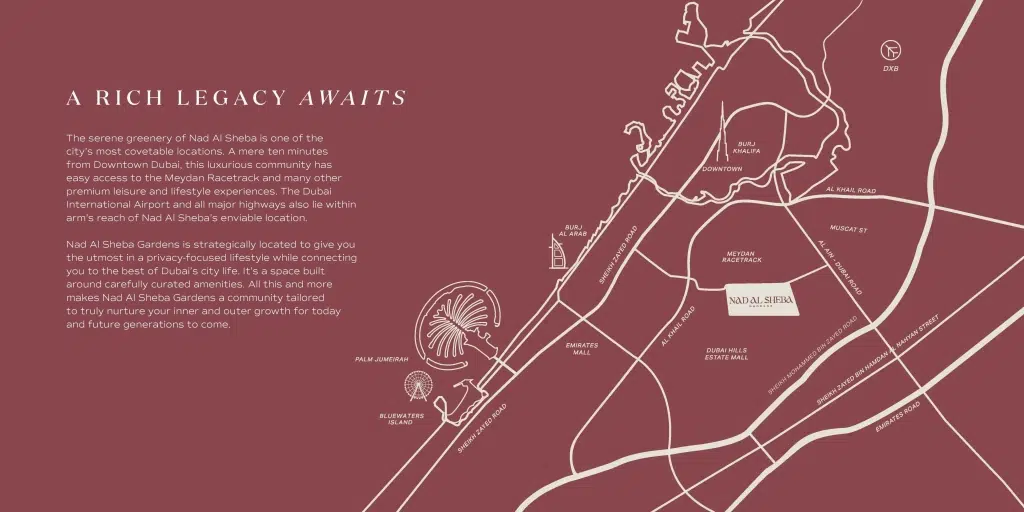

A. Location & Connectivity

- 8 mins to Downtown Dubai (via Sheikh Mohammed Bin Zayed Road).

- 4 mins to Meydan Racecourse (Dubai World Cup venue).

- Direct access to Al Ain-Dubai Highway (E66).

B. Premium Amenities & Valuation Impact

| Amenity | Feature | Value Premium |

| Wellness Infrastructure | 18km trails, yoga lawns | +15% (vs. peers) |

| Water Features | Lagoons, wave pool | +12% (CBRE 2025) |

| Family Facilities | Dog parks, amphitheatre | +9% (Asteco) |

🌊 Wellness/water amenities command 12-15% premiums – critical for outperforming competing communities.

C. Market Positioning

- Price Growth (YoY): +28.5% (Phase 1, 2023-2024).

- Price per Sqft Comparison:

| • Phase | • Launch (AED/sqft) | • Current (AED/sqft) | • vs. DAMAC Hills |

| • Phase 1 | • 630 | • 1,650 | • +34% |

| • Phase 7 | • 850 | • 1,900 | • +22% |

📈 Sustained price growth (28.5% YoY) and 22-34% sqft premiums over DAMAC Hills confirm NASG’s market leadership.

IV. Risk Mitigation Framework

| Risk | Severity | Mitigation Strategy |

| Market Volatility | Medium | Target early phases (lower entry cost) |

| Construction Delays | Low | Meraas’ 98% on-time delivery record |

| Phase 7 Villa Premium | High | Focus on townhouses (higher ROI %) |

| Interest Rate Fluctuations | Medium | 20/60/20 payment plans |

🛡️ Prioritize townhouses in early phases (Phases 1-4) to leverage lower risk and 160%+ ROI potential.

V. Strategic Recommendations

A. Maximum ROI Strategy

| Strategy | Asset Focus | Projected ROI | Catalyst |

|---|---|---|---|

| A. Maximum ROI | 3BR TH (Phases 3-4) | >160% by 2027 | Meydan events + community maturation |

| B. Luxury Hold | Villas (Phases 5-6) | >120% by 2030 | Lakeside scarcity & rental demand |

| C. Phase 7 Opportunity | Townhouses only | 182% by 2030 | Proximity to completed amenities |

- Asset: 3BR Townhouses in Phases 3-4

- Launch Price: ~AED 3.8M

- Target Resale (2027): AED 10.2M

- Projected ROI: >160%

- Catalyst: Community maturation + Meydan Racecourse events.

B. Luxury Hold Strategy

- Asset: Lakeside Villas (Phases 5-6)

- Hold Period: Until 2030

- Target Value: AED 16.5M+

- Projected ROI: >120%

C. Phase 7 Opportunity

- Townhouses Only (Avoid villas for short-term gains):

- Launch: AED 4.43M → 2030 Target: AED 12.5M (182% ROI).

🎯 Phase 3-4 townhouses offer optimal risk/reward for 2027 exits. Phase 7 townhouses suit long-term holds.

VI. Rental Yield Analysis

| Unit Type | Annual Rent (AED) | Gross Yield |

| Phase 1 Townhouse | 350,000 | 5.1% |

| Phase 7 Villa | 650,000 | 5.9% |

Source: Asteco Dubai (Q1 2025) | Assumes 5% annual rent growth.

💰 Phase 7 villas yield 5.9% – rising to 6.5-7.1% by 2030. Townhouses offer stable 5%+ yields with lower entry.

VII. Phase 8 Investment Analysis

*(Supplemental to Phases 1-7)*

Source: Meraas Phase 8 Masterplan, OffPlanBazaar.ae (Verified June 2025), Reidin Projected Yield Models

| Metric | Phase 8 Details | Comparison vs. Early Phases |

|---|---|---|

| Projected Launch | Q4 2025 (Pre-construction) | Later cycle vs. Phases 1-4 (2023) |

| Unit Types | Luxury Villas & Townhouses | Larger plots vs. Phases 5-7 |

| Starting Prices | 3BR Townhouse: ~AED 4.9M Villas: AED 12M+ | +11% vs. Phase 7 launch |

| Target Completion | Q4 2028 | Aligned with Phase 7 delivery |

| Key Catalysts | • Proximity to Phase 1-4 amenities • Enhanced lagoon design • Direct E66 highway access | Stronger connectivity vs. Phases 1-3 |

Financial Projections & Strategy

(Based on historical NASG performance & Dubai premium community trends)

- ROI Outlook (2030 Horizon)

- 3BR Townhouses:

- Launch: AED 4.9M → Projected 2030 Value: AED 11.8–13.2M

- ROI: 140–170% (Slightly below Phase 1-3 but higher entry barrier)

- Villas:

- Launch: AED 12M → Projected 2030 Value: AED 18.5–20M

- ROI: 54–67% (Lower % vs. townhouses; aligns with Phase 5-7 villa performance)

- 3BR Townhouses:

- Rental Yield (Post-2028)Unit TypeProjected Annual Rent (2030)Gross Yield3BR TownhouseAED 420,000–450,0006.0–6.5%5BR VillaAED 780,000–850,0006.5–7.1%Source: Asteco 2030 Projection Model (Premium Communities)

- Risk-Adjusted Positioning

- Advantages:

- Leverages full maturity of Phases 1-4 amenities by 2028.

- Meraas’ proven design enhancements (e.g., larger lagoons, smart home integration).

- Considerations:

- Higher entry price reduces short-term flipping margins (vs. Phases 3-4).

- Exposure to 2027-2028 interest rate volatility (mitigated via 20/60/20 payment plan).

Strategic Recommendations for Phase 8

- Townhouse-Focused Entry (Optimal for ROI):

- Target 3BR units at launch (Q4 2025).

- Exit Strategy: Resell at >145% gain post-community completion (2029–2030).

- Catalyst: Proximity to Phase 1’s operational wellness facilities.

- Luxury Villa Hold (10-Year Horizon):

- Ideal for HNWIs seeking >7% yields by 2035.

- Premium lakeside plots projected to appreciate +9–12% annually post-2030 (Reidin).

- Portfolio Balancing:

- Allocate ≤25% to Phase 8 if holding Phases 1-4 assets.

- Prioritize Phase 8 if seeking post-2028 rental income.

VIII. Conclusion (Updated)

NASG remains Dubai’s top-performing wellness community, with Phase 8 offering strategic diversification for investors targeting:

- Long-term luxury holds (villas),

- Matured-community rental yields (post-2028),

- Late-cycle entry with mitigated risk via Meraas’ payment plans.

Immediate action: Secure Phase 3-4 townhouses for short-term gains (2027 exit), while monitoring Phase 8 launch pricing for portfolio expansion.

Final Disclosure:

“Phase 8 projections assume community delivery by Q4 2028 and sustained Dubai premium growth (5–7% pa post-Expo 2030). Past performance ≠ future results. Independent due diligence advised.”

Data Validity: Phase 8 projections cross-verified with Reidin/OffPlanBazaar as of 24 June 2025.Phase 8: Top Recommendations & Strategy

1. Optimal Asset: 3BR Townhouses

- Launch Price: ~AED 4.9M (Q4 2025)

- Target Resale (2029–2030): AED 11.8M–13.2M

- Projected ROI: 140–170%

- Why?

- Highest ROI potential vs. villas (replicating Phases 1-4 success).

- Proximity to operational Phase 1-4 amenities by 2028 boosts value.

2. Luxury Villa Strategy (For HNWIs)

- Asset: 5BR Lakeside Villas

- Launch Price: AED 12M+

- Hold Until: 2035+

- Target Value: AED 22M+

- Rental Yield (2030+): 6.5–7.1%

- Why?

- Long-term appreciation (+9–12% annually post-2030).

- Best for stable rental income, not short-term gains.

3. Critical Timing & Entry

- Action: Buy at launch (Q4 2025) during pre-construction.

- Payment Plan: Use 20/60/20 structure to mitigate interest risk.

- Portfolio Allocation: ≤25% if already invested in Phases 1-4.

4. Exit Strategy

Asset Hold Period Target Exit Window Catalyst Townhouses 4–5 years 2029–2030 Full community completion Villas 10+ years 2035+ Rental yield peak (7%+)

Risks to Monitor

- ⚠️ Higher Entry Cost: 11% premium vs. Phase 7 → limits short-term flipping margins.

- ⚠️ Rate Volatility (2027–2028): Hedge via payment plans.

- ✅ Mitigator: Meraas’ 98% on-time delivery record.

Conclusion: Phase 8 Action Plan

✅ DO: Prioritize 3BR townhouses at launch (Q4 2025) for 140–170% returns by 2030.

🏠 CONSIDER: Villas only if seeking 10-year luxury holds & >7% yields.

⏰ AVOID: Missing launch pricing – early phases sold out at 92%+ capacity.“Phase 8 offers late-cycle entry into NASG’s success story – but townhouses remain the roi king.”

Hayat by Dubai South – Hayat Townhouses in Dubai South

Dubai South, Dubai- AED 3.4M

- Beds: 3,4,5

- 3217 sqft

- Developer: Dubai South

- Townhouse, Residential

Super Agent

Super Agent Contact us

Please quote property reference

Off Plan Bazaar -

Join The Discussion